KARACHI: Pakistani currency hit a much-anticipated level of Rs170 against the US dollar in the interbank market on Wednesday.

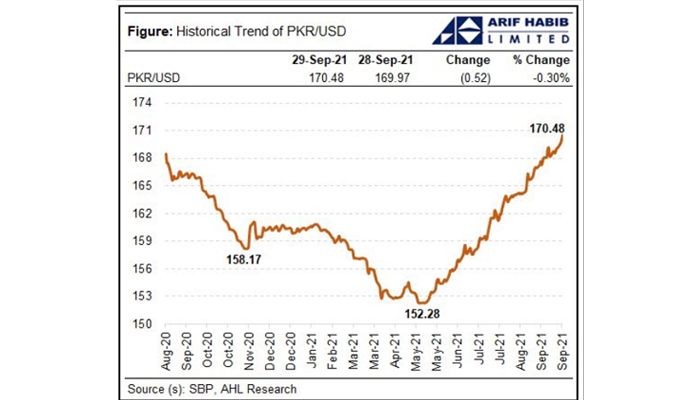

The rupee dropped to a historic low of Rs170.48 with a fresh decline of 0.30% or 51 paisas.

According to the State Bank of Pakistan (SBP), the local currency had closed at Rs169.97 against the greenback on Tuesday.

The rupee further lost ground to an increase in demand for the dollar on the back of historic high trade and current account deficit.

With the latest drop of 0.30%, the local currency has depreciated 8.21% or Rs12.54 since June 2021 and 11.95% (or Rs18.21) since its recent high of Rs152.27 recorded on May 14.

Apparently, the authorities are letting the currency depreciate to discourage rising imports and encourage exports in an attempt to narrow down the widening trade deficit, which poses a threat to the country’s economy.

According to the Pakistan Bureau of Statistics, Pakistan’s two-month (July-August) trade deficit widened 120% to $7.5 billion after imports saw a new historic peak but exports plunged for the third successive month despite heavy subsidies being given to exporters and significant currency devaluation.

Moreover, the rupee may be moving down in search of the value that can help resume the International Monetary Fund’s (IMF) $6 billion loan programme, which has been on hold for the last two months. The country is set to hold staff-level talks with the IMF on resuming the programme on October 4.

Speaking to Geo News, financial expert Farhan Bukhari said the major reason behind constant currency devaluation is the “rapidly increasing trade deficit”. The widening deficit has increased the demand for the dollar.

Bukhari said: “The ongoing situation in Afghanistan also negatively impacted the Pakistani currency.”

The expert was of the view that people have started raising questions regarding the intervention by the central bank. “When will the SBP utilise the historic high reserves present in the country.”

Endorsing his views, Alpha Beta Core CEO Khurram Schehzad said that recently the central bank increased the policy rate by 25bps to 7.25% which was a step taken to stabilise the rupee-dollar parity, however, a meagre hike of 25bps will not be as effective.

“The prices of food items and energy commodities are increasing in the international market, therefore, the central bank does not have much leverage to take drastic steps,” he said, adding that the central bank cannot increase its policy rate massively because the economy hasn’t restored completely.

Shedding light on the soaring inflation, the analyst said that the increase in the local inflation rate is because of an increase in global inflation.

“We need to harmonise the monetary and fiscal policy, if both these policies will move in separate directions, the economy will suffer badly,” Schehzad recommended.

Forex Association of Pakistan President Malik Bostan told Geo News that the currency is majorly depreciating because of the situation in Afghanistan.

“Pakistan’s import bill is also increasing because of the uncertain situation in the neighbouring county. Since the accounts of Afghans have been frozen, the traders there are importing essential commodities from Pakistan and hence Pakistani importers have also increased their import orders to fulfill the local as well the demand of Afghanistan,” he explained.

Bostan reiterated that Pakistan needs to increase its exports or else the “widening import bill will devastate the economy of Pakistan.”

Highlighting another perspective of the situation, economic expert Muhammad Sohail said that other than the economic factors, Pakistan’s politics is also affecting currency parity.

Schehzad added that it is a natural phenomenon that when the demand of commodity increases, keeping in mind the limited supply, the price increases.

The CEO recalled that earlier the central bank had predicted that this year the current account deficit will reach 2-3% of the GDP because imports are increasing, while the growth quantum of exports is not up to the mark.

Pakistan’s current account deficit – the gap between the country’s higher foreign expenditures and sluggish income – widened to $1.5 billion in August 2021.

He added that a few weeks ago the SBP had injected some dollars into the market to stabilise the rupee against the US dollar.

Talking about ways to control imports, the analyst said that the central bank does not have much space to reduce imports because 70-80% of the total imports are of essential goods.

Experts predict the currency will stabilise or consolidate in October after a successful review of the IMF programme.