The foreign exchange reserves held by the State Bank of Pakistan (SBP) increased by $12 million to $8.05 billion on a week-on-week basis, the central bank said in a statement on Thursday.

The total liquid foreign reserves held by the country stood at $13.379 billion as of August 11, the communique added.

The net reserves held by commercial banks stood at $5.3237 billion, according to the central bank.

However, the central did not mention the reason for the increase in the foreign exchange reserves.

The current reserves are enough to cover over two months of imports.

Last month, the SBP reserves got a major boost after Pakistan received funds from UAE, Saudi Arabia and International Monetary Fund (IMF) after the global lender signed a $3 billion Stand-by Arrangement (SBA).

The SBP also maintained the key policy rate at 22% last month against market expectations as the analysts were expecting an increase in the interest rate on IMF guidelines.

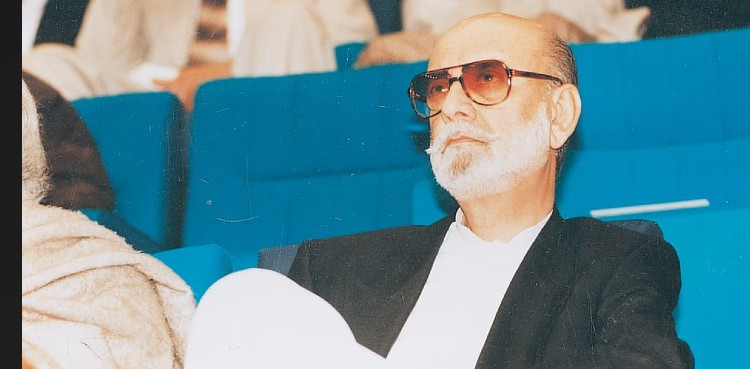

The decision was announced by SBP Governor Jameel Ahmed following the Monetary Policy Committee (MPC) meeting.

“In view of the decline in inflation, the SBP decided not to increase the interest rate,” he added.

Addressing a press conference, the central bank’s governor said the growth rate is expected to remain between 2% to 3% over the next year.

He said the government has lifted all restrictions on imports and the country’s foreign exchange reserves increased by $4.2 billion in July after Pakistan received funds from the International Monetary Fund (IMF) and other friendly countries.

The central bank chief said the foreign exchange reserves held by the SBP stood at $8.2 billion and they will improve further in December this year.

SBP Governor Ahmed said more loans will be rolled over in the coming months, adding that according to the MPC inflation is expected to come down.

The SBP has raised its key policy rate by 12.25 percentage points since April 2022, mainly to curb soaring inflation.