Financial Action Task Force (FATF) has refused to remove Pakistan from it grey list. Pakistan will now remain on FATF’s grey list till October 2021.

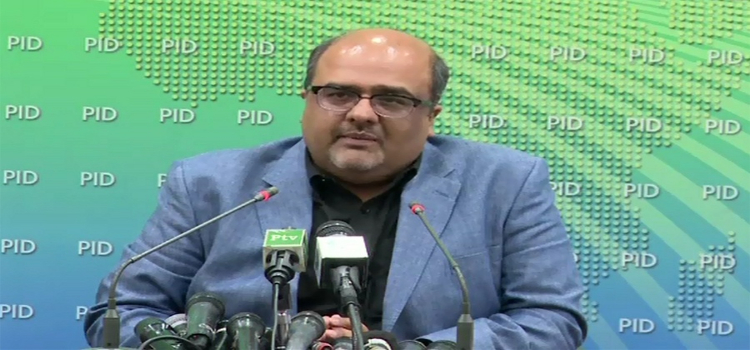

Dr Marcus Pleyer – FATF President, held a press conference on Friday (today) following the culmination five-day plenary meeting from June 21st to June 25th in Paris.

The virtual meeting of the FATF Plenary took place under the presidency of Dr Marcus Pleyer, while delegates representing 205 members of the Global Network and observer organisations including the International Monetary Fund, the United Nations and the Egmont Group of Financial Intelligence Units were also in attendance.

Addressing the press briefing, Dr Marus Pleyer apprised that Pakistan will remain on FATF grey list till October 2021 as the country needs to do more to address and tackle terror financing-related matters.

FATF President acknowledged that Pakistan had in fact made significant progress and has successfully addressed 26 out of the total 27 points regarding the plan of action issued by FATF earlier.

There remains risk of money laundering, said Dr Marcus Pleyer.

The FATF encourages Pakistan to continue to make progress to address as soon as possible the one remaining CFT-related item by demonstrating that TF investigations and prosecutions target senior leaders and commanders of UN designated terrorist groups, read the statement FATF press-release.

FATF Recommendations

- Pakistan to continue to make progress to address as soon as possible the one remaining CFT-related item by demonstrating that TF investigations and prosecutions target senior leaders and commanders of UN designated terrorist groups.

- Enhance international cooperation by amending the MLA law.

- Demonstrate that assistance is being sought from foreign countries in implementing UNSCR 1373 designations.

- Demonstrate that supervisors are conducting both on-site and off-site supervision commensurate with specific risks associated with DNFBPs, including applying appropriate sanctions where necessary.

- Demonstrate that proportionate and dissuasive sanctions are applied consistently to all legal persons and legal arrangements for non-compliance with beneficial ownership requirements.

- Demonstrate an increase in ML investigations and prosecutions and that proceeds of crime continue to be restrained and confiscated in line with Pakistan’s risk profile, including working with foreign counterparts to trace, freeze, and confiscate assets.

- Demonstrate that DNFBPs are being monitored for compliance with proliferation financing requirements and that sanctions are being imposed for non-compliance.

Read More: FATF acknowledges Pakistan’s success

Prior to this, FATF’s Asia Pacific Group (APG) on money laundering had acknowledged Pakistan’s notable progress and success in addressing various complaints and issues raised by the watchdog.

In its Mutual Evaluation Report, FATF has revealed that Pakistan has successfully complied with 31 out of the total 40 recommendations made by the watchdog aimed at addressing money laundering and various other issues.

It is to be noted that Pakistan has been on FATF’s grey list since June 2018. The countries included in FATF grey list are subjected to increased monitoring by the watchdog.